According to a recent Wall Street Journal article, house flipping is back to pre-crisis levels. There are dozens of house flipping TV shows on HGTV, TLC, and other networks, not to mention hundreds of house flipping seminars, workshops, and paid programs offered by so-called experts in the field. Flipping houses is undeniably sexy right now. New investors are drawn by the promise of quick profit and the allure of being called a “real estate investor.” But, is flipping houses really worth it if you are a beginner just starting out in real estate?

My answer is an emphatic, NO! Allow me to explain.

____________________________________________________________________

DISCLAIMER: The views and opinions expressed in this article are my own alone and do not necessarily represent those of my law firm or any of my business partners. Nothing in this article should be construed as legal advice. Readers are strongly encouraged to do their own research and to consult with their own attorney or financial adviser before making any legal or financial decisions based on this article’s contents.

____________________________________________________________________

Average Profit on a Flip.

First, let’s address the profit margin in flipping. If you have been around the internet for any period of time, you may have seen ads and articles that talk about how an average profit per house flip across the country is $60,000 (or more). But where does this number actually come from?

It comes from a company called ATTOM Data Solutions (“ATTOM Data”), a property data and research company which collects and analyzes a variety of real estate data from across the nation and publishes its conclusions with regard to trends and direction of the market. In its most recent report on house flipping data, ATTOM Data stated that “[h]omes flipped in Q1 2019 sold at an average gross profit of $60,000.”

The way that ATTOM Data arrived at the $60,000 number is they looked at houses that sold twice in a 12 month period, subtracted the purchase price from the sale price and then averaged the results across all sales. At first glance, that sounds like a lot. But, note the subtle wording — it is the “average gross profit.” That means that no expenses have been factored into this number at all.

This of course is less than helpful to anyone trying to figure out if flipping houses is worth the trouble. It gets even worse when ads, news articles, and blog posts disingenuously omit the word “gross” when quoting ATTOM Data’s figures. It gives readers and viewers a false impression of just how lucrative house flipping is.

So, what is the actual average net profit?

Well, to figure that out, you need to know what expenses project incurred. This information is not publicly available and likely varies drastically depending on location and extent of rehab. But, I can offer some educated estimates based on types of expenses you are likely to see. Keep in mind the actual numbers are likely to be different in your area. But, this will at least give you an idea of what categories of expenses you should account for and you can plug in the numbers that are more typical in your area.

To keep in line with the $60,000 average gross profit, let’s assume that you buy the house for $100,000 and sell it for $160,000. What expenses are you likely to see?

Cost of Financing.

Most people do not have $100,000 or more lying around to invest in a flip. That means that they will have to finance the purchase. Since most flips involve distressed properties which require substantial rehab, most traditional banks will not lend on this type of purchase. Additionally, even if a bank could lend, flippers may not have time to wait for a bank to process the application and issue a loan if they are buying it from a wholesaler or if there are other buyers competing for the property who are willing to put up cash.

So, what most investors end up doing is financing the purchase through a hard money lender. Hard money lenders are professional lenders who are in the business of making short term loans (“hard money loans”) to real estate investors. Hard money lenders have much lower qualification criteria in terms of credit and financial standing than banks. But, their interest and fees are much much higher.

It is typical for hard money loans to be “interest only” loans, where the monthly payments are comprised of only the interest that had accrued that month and where the principal balance is paid in full at the end of the term of the loan. Loan terms typically range from six months to two years. The interest rates range anywhere from 10% to 16%.

In addition to the high interest, hard money lenders also charge “points.” Points are essentially pre-paid interest that the borrower pays (or, more typically, is subtracted from the loan principle) at the beginning, the end, or both at the beginning and the end of the loan term. One point is equal to 1% of the total loan principal. Hard money lenders typically charge anywhere from 0 to 6 points per loan.

So, let’s say that in our example, you are able to get a $100,000 loan at 12% interest and with 4 points. And let’s say that the rehab and sale, from start to finish, takes you six months to complete. Actual time frames can vary based on many different factors. But, six months as an average is not unreasonable in my opinion.

This means that after six months you will end up paying $6,000 in interest and another $4,000 in points, for a total financing cost of $10,000. Once we subtract this cost from our gross profit, we are left with $50,000. Let’s keep going.

Closing/Transaction Costs.

When you buy and sell property, you are also going to incur a variety of governmental and transactional costs and fees. These consist of the following:

Purchase:

- Attorney’s fees

- Mortgage tax

- Title Insurance

- Recording/escrow fees

Sale:

- Attorney’s fees

- Transfer tax/Deed Stamp Tax

- Recording fees

- Real Estate Commissions

The exact numbers for each of these expenses will vary from state to state and county to county, but on $100,000 purchase and a $160,000, it is reasonable to assume that they will amount to at least another $10,000 and possibly closer to $15,000.

There is not much you can do about most of these costs as they are fixed by custom or government requirements in your area. But, you can offset one of them — real estate commissions — if you have your own real estate license. The pros and cons of getting your real estate license is a topic for another article, but in my opinion it is definitely worth it as typical commission cost to seller is 6% of the sale price in most areas.

In our example, 6% on $160,000 sale would equal $9,600. Some brokers will give clients a discount, so maybe you will end up paying a little less, but the real estate commission is still likely to be your biggest closing expense. If you had your own real estate license, you would at least be able to offset some of it (you would still have to pay something to the agent who brings the buyer, typically 2.5% and you would split the rest of the commission with your broker at the split that you and your broker agreed upon).

Shameless plug — if you are in New York, and are interested in becoming a real estate agent or already have your real estate license and are looking for a brokerage, check out our brokerage: Serenity Real Estate Team. We are always looking for new talented agents who are interested in joining the team.

Carrying Costs.

After subtracting the financing and the closing costs, you have approximately $35,000 to $40,000 remaining of your average profit. The next set of costs are called carrying costs. These include:

- Property taxes

- Property Insurance

- Utilities

- Water/Sewer

- Garbage

- HOA Fees

There may be other costs in your area as well, so be sure to find out what they are when you evaluate a deal. In Upstate New York, on a property that is worth $160,000, these costs are likely to add up to approximately $5,000 over the course of six months.

After you subtract the carrying costs, you are left with approximately $30,000 to $35,000. Great! That’s your final net profit, right? Wrong! We haven’t yet accounted for the biggest expense of all — the rehab cost.

Cost of Rehab.

Correctly estimating the after repair value (“ARV”) and the cost of repairs are the areas where beginner house flippers make the most mistakes.

When it comes to estimating repair costs, the first factor to consider is the initial condition of the property. Repair costs can range from a few thousand dollars if a house is in pristine condition to tens of thousands of dollars or more. Does your property look like this?

Or does it look more like this?

If it is the former, you are definitely going to spend more than $35,000 on repairs. If it is the latter, then maybe you can get away with a $20,000 rehab. It is very easy to spend $20,000 even on the smallest project. Take this house that one of our wholesale clients is rehabbing right now for example.

It is a 2 bedroom, 2 bath, 1000 square-foot home. These are the photos of the house at the time of purchase before any rehab was done:

The rehab being done on it is considered to be fairly “light.” The investor is adding a wall, a few doors, flooring in a couple of rooms, a little bit of electrical, minimal plumbing, painting, and some exterior work. At the end of the day, this rehab is going to cost him right around $20,000.

Subtracting the $20,000 from your remaining profit, you are left with $15,000, at most. $15,000 is not amazing, but it isn’t terrible. But, we are still not done…

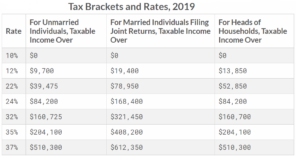

Taxes.

Unlike long-term buy-and-hold investments, house flipping profits are taxed at the investor’s ordinary tax rates. As of the time of this writing, the federal taxes on ordinary income range from 10% to 37%.

The exact percentage that you will owe in federal income tax will depend on your total taxable income for the year. In addition to federal income tax, your flipping profit may also be subject to social security/payroll taxes. If any amount of your flipping profit when added to your other earned income is below the Social Security Wage Base (which as of the time of this writing is $132,900), you will owe an additional 15.3%. This is double what you pay as an employee, because the income earned from flipping profit is considered to be self employed income which is subject to both the employee and the employer portion of the tax.

Additionally, if you live in a high income tax State like New York, you will also owe anywhere between 4% and 8.82% in state income taxes.

According to a USA Today article from a couple of years ago, the average person pays approximately 30% of their income in taxes. To be fair, the USA Today calculations included property taxes, but they did not account for the employer portion of payroll taxes that you would have to pay on flipping income as described above. I think it is fair to assume that most people will likely end up paying at least 1/3 of their flip profit to Uncle Sam.

Final Net Profit.

Subtracting 1/3 of the remaining $10,000-$15,000 of profit on our hypothetical flip, leaves you with somewhere around $6,666-$10,000 final net profit. This is the profit you might expect to make after six months worth of work if you buy an average deal, do an average rehab, and achieve average results.

Why You SHOULD NOT Flip if You Are Just Starting Out.

The problem, aside from $10,000 being a pretty low average return for six months worth of work, is that beginners who have never flipped a house or done anything else with real estate just do not have the experience necessary to execute an average flip deal effectively. Mistakes are guaranteed and mistakes cost money.

In order to get the $10,000 profit on the hypothetical average deal I described, you have to do everything right. You have to get your financing at the rates described (most hard money lenders will charge a newbie 16% interest simply because they do not have experience and are a riskier borrower), you have to estimate rehab costs correctly, you have to find good contractors and manage their work, you have complete the rehab in six months, and you have to actually sell the property at or above your ARV. If you make a mistake in any one of these categories, you do not end up with a $10,000 profit, you end up with a loss.

What if during the rehab you find a serious problem that you did not anticipate? This happens on every house flipping TV show, but yet somehow, miraculously the flippers end up making up the cost in some other area. That’s not how it works in real life. ATTOM Data’s average gross profit does not leave you with any room for those kinds of mistakes.

What if the local market suddenly takes a dive and you can no longer sell the property for what you were planning to sell the property? What do you do then? Most single family flips are not easily turned into profitable rentals. If this forces you to exceed the length of your short term hard money loan, the hard money lender will charge you additional fees to extend the loan, or worse, the hard money lender may foreclose and take the property away from you altogether.

In my opinion it is simply too risky for new investors to get into flipping houses as their primary real estate investing strategy.

How You CAN Flip if You Are Just Starting Out.

You don’t agree with me. You still want to flip. Okay. Here is what you should do if you simply must get into flipping right from the get-go.

First, learn everything you can about flipping. Watch YouTube videos, read blog posts, and read as many books on the subject as you can get your hands on. Two of the best books out there right now are “The Book on Flipping Houses” and “The Book on Estimating Rehab Costs,” both by J. Scott. They are an invaluable source of information for anyone who has an interest in rehabbing and flipping houses.

You can pick up both of these books on Amazon. Click on the cover images below. These are my affiliate links and I will make a small commission (at no extra cost to you) if you decide to purchase them through these links. Obviously, there is no obligation to do so, but it would support this blog and allow me to continue creating valuable articles like this one.

Second, once you have gotten a baseline of theoretical education, you should go and find experienced flippers in your area, meet with them, pick their brains, and try to see how they do what they do. If you do not know any flippers, the best place to find them is at your local real estate meet up group. Go there and network! But, don’t expect to just be able to come up to them and ask the to teach you everything about their flipping business. If you do that, you will look foolish.

You need to try to develop a genuine connection with them. The best way to do that is to offer them value. And I don’t mean paying them for coaching or spending thousands of dollars on a house-flipping seminar. I am talking about offering them your time, efforts, and skills that you may have that can help them in their business. Your goal is to observe them in action and learn what they do and how they do it. If you can help them make money, they will be more willing to pass their knowledge and experience onto you. Experience is what you should be trying to get. You want to short-cut your way to experience without breaking even or losing money on your first few deals. One way to do that is to work for an experienced flipper.

Last, but not least, is, if you can, try to get an experienced flipper to partner with you on your first deal. You may have to bring the deal to them, you may also have to obtain financing on your own, and you may have to offer them a substantial portion of the profit in exchange for their knowledge and experience. This is, by far, the best and the least risky way to get into flipping if you are really dead-set on doing it.

Even with all these steps and strategies, making money on your first few deals may be a challenge. If you cannot afford to spend six months of effort and break even or take a loss on a deal or two before you get the hang of it, then I would strongly encourage you to try one of the other less-risky and time-consuming real estate investing strategies.