So, you’ve got a bunch of EIDL money sitting in a bank account, doing nothing but costing you 3.75% interest while you wait for qualifying expenses to come along so you can use that money. Wouldn’t it be nice if you could invest some of that money in say Tesla stock? As of the time of this writing, it is up over 480% year-to-date in 2020!

Or, how about just putting it into an index fund that tracks the S&P 500? Despite the catastrophic downturn earlier in the year, the S&P is up over 7.5% year-to-date as of the time of this writing.

Or, heck, maybe you want to follow Graham Stephan’s recommendation and put your money in a high-yield savings account with Yotta Bank?

These all sound like good ideas. But, just as anything with the SBA, the question is: is it legal? Can you invest your EIDL money?

Okay, so, as I’m sure you know by now, the SBA places a lot of restrictions on how you can use your EIDL funds. I’ve done at least three videos before talking about this topic.

But, one question that has continued to come up that I haven’t directly addressed before is whether a borrower can temporarily invest the EIDL money in something that will earn them a positive interest return.

As usual, public SBA guidance on this point is, well, non-existent. The SBA guidance says that you cannot purchase any “fixed assets” with your EIDL funds, which includes investment real estate. But, it doesn’t say anything about investing in the stock market or putting the money in an interest-bearing account.

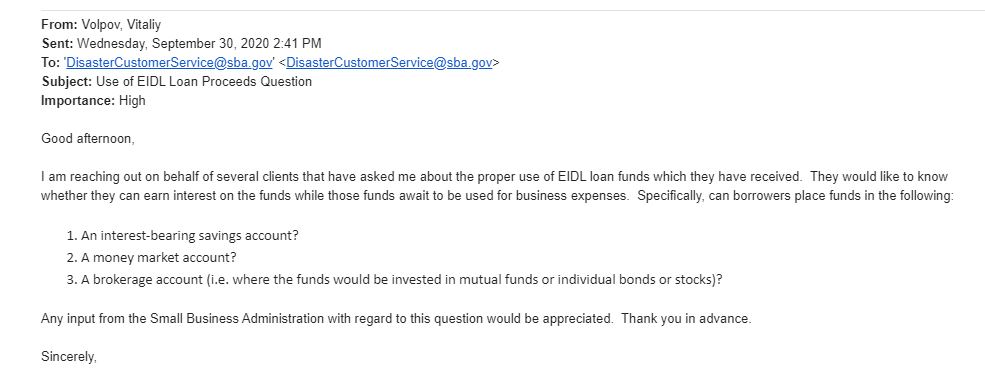

So, I did what any inquisitive attorney would do and e-mailed the SBA’s disaster customer service. In my e-mail, I asked the SBA if a borrower can put their EIDL funds in one or more of the following accounts:

1. An interest-bearing savings account?

2. A money market account?

3. A brokerage account (i.e. where the funds would be invested in a mutual fund or individual stocks or bonds)?

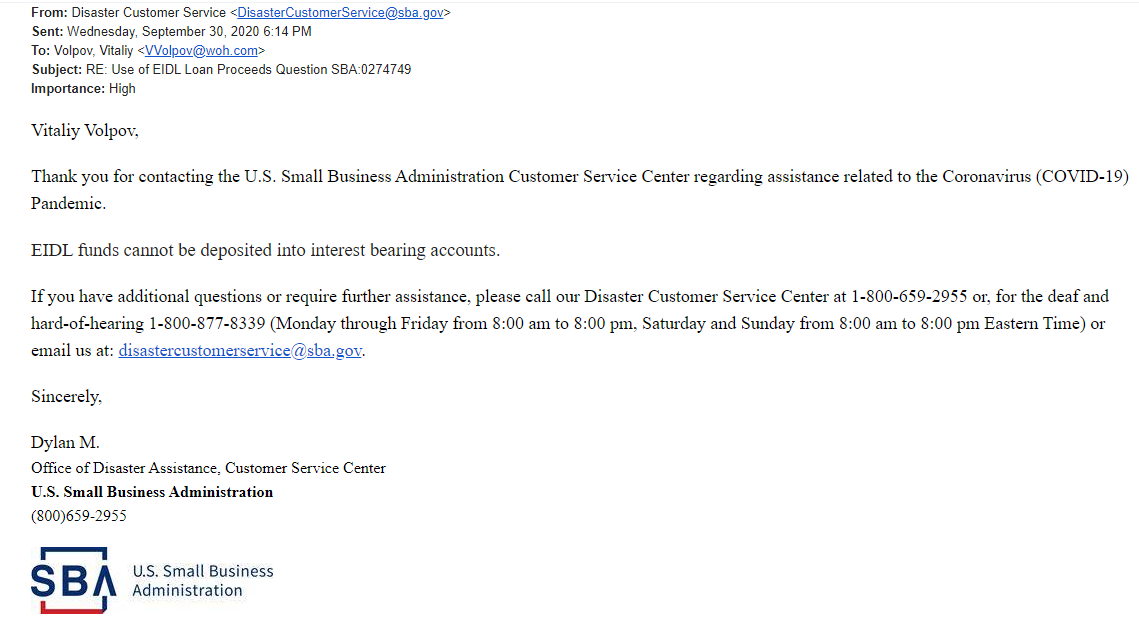

Honestly, I did not expect to get an answer. And I definitely did not expect to get an answer the same day! But, sure enough, a few hours after I sent my e-mail, I saw a reply e-mail from the SBA in my in-box. Can you guess what the answer was?

That’s right. The answer was “no.” More precisely, the answer was “EIDL funds cannot be deposited into interest bearing accounts.” That means, “no” to a brokerage account. “No” to a money market account. “No” to a savings account. And, technically-speaking, it is even a “no” to an interest-bearing checking account as well.

If you are a borrower, I know that you may have hoped for a different answer. But, considering the other restrictions the SBA has placed on these funds, are you really that surprised?

The purpose of the EIDL program was to help businesses struggling to pay their expenses as a result of the coronavirus pandemic. It was not intended to subsidize business owners’ stock market investments.

The silver lining here is that you can still use these funds toward your business “operating expenses” as they come up. Since you won’t have to use your personal funds for operating expenses, you can hopefully set them aside and use them for investment purposes.

I know that putting a few hundred dollars into the stock market every so often is probably not as exciting as sticking $100,000 of your EIDL funds into Tesla stock and hoping to double it in the next three months. But, honestly, that’s probably a good thing.

Let dollar-cost averaging work in your favor. Contributing smaller amounts consistently over time has proven to be much more profitable over the long term. And the best thing is, you won’t put yourself at risk of losing most of your EIDL funds in a market downturn and then having the SBA come after you for an additional 50% penalty on top it for improperly using the funds!

On a side note, if you are planning to invest in the stock market using your personal funds, I would highly recommend using a commission-free platform like Webull.

I have been using Webull for my personal investments and I think it is a very good platform.

As I said, it’s commission free, their mobile app is very easy to use, and there are no minimums. You can invest in individual stocks, mutual funds, ETF’s, options, you name it.

If you sign up using my link in the description below and you deposit $100, Webull will automatically deposit 2 free stocks into your account each valued between $8 and $1,600. So, at minimum, you would get $16 just for signing up.

Full disclosure, I am affiliated with Webull. So, if you do sign up using my link, I will get a small referral fee at no extra cost to you. If you enjoy the content that I provide on this blog and on my YouTube channel and you are interested in investing in the stock market, signing up for Webull is a great way to show your appreciation for all the hard work that goes into bringing you valuable content.

In any case, I appreciate you checking out this post and the YouTube video linked above. See you soon!

This was the exact thing I was looking for. Although disappointing, you have saved me from some potential trouble.

Thanks

Tony C

Hello Mr. Volpov,

Great video! I would like to clarify one thing: the conclusion of the video was you are not allowed to deposit EIDL funds into an interest bearing account, at the same time, you mentioned one can just use personal funds towards investing. With that said, I have $200K in my Bank of America business checking account that money is currently used for my operating expenses. I am planning on depositing my EIDL funds into a separate account with Bank of America and use those funds moving forwards for all operating expenses, now that would free up my $200K and I would like to transfer that money via share holder distribution to my personal account and use those funds towards investing purposes. Please let me know your thoughts. Thank you

If the loan money was first used for inventory and the inventory was sold. Can the money from the sales of the inventory then be used for buying stocks?

I emailed the sba also and would like to here your point of view. My question was can I pay down my 7a loan. The guidance from the sba says you can pay down commercial debt but not federal debt to include the sba. I don’t know if a 7a loan is considered commercial debt or sba debt. It is done through a private lender.

What do u think now that the SBA has approved buying equipment and changed the verbiage regarding prepayment and past debts? Could you now buy real estate and invest in stocks or other investment strategies to offset the interest rate?

https://www.sba.gov/article/2021/sep/09/sba-administrator-guzman-enhances-covid-economic-injury-disaster-loan-program-aid-small-businesses

thnx

Hi

Great article!

I wanted to see your opinion on another way to use the EIDL.

What if someone used the EIDL for payroll and rent (working capital) for several months and let their income/cash flow increase. Couldn’t you use that money to invest?

Assuming your business was already making money and profitable

The SBA itself answered this in a publication and the answer is yes. The government will deposit EIDL funds into a savings account, which is interest bearing, per the SBA. https://www.sba.gov/sites/default/files/articles/5-18-20_FAQs_v3_003.pdf