You may or may not know this, but there are actually several different accepted methods for determining the value of real estate. They include, the cost approach, the comparable sales approach, and the income approach. Let’s talk about the cost and the comparable sales approaches first, and then focus on the income approach, since the income approach is the one that matters most for larger multi-family properties.

For a video I did on this topic, tap or click on the thumbnail below. If you prefer the written version, read on!

The Cost Approach.

The cost approach is how much it would cost someone to build an identical property in the same location, using today’s costs for labor and materials. If you’ve ever had an insurance policy on a property, that is most likely the approach that your insurance company used in order to get the policy value.

Of course, with this approach, the value comes out to be much more than what you may have actually paid for the property. I have had policies on properties purchased for $200,000, come in at over $400,000.

Obviously, with these types of ranges, this method, in its pure form, is not the most accurate way of valuing a property. For this reason, a lot of appraisers will actually discount the replacement cost by some amount of depreciation based on the age of the property and other factors. But, of course, when they do that, their final number becomes more subjective and less accurate. In fact, although appraisers include the cost approach on their appraisals, they usually do not rely on it for the ultimate determination of value.

The Comparable Sales Approach.

The next approach is the comparable sales approach. And this is the approach that most people are familiar with.

The way a comparable sales approach works is that you take into account all of the features of the property you are trying to value (i.e. bedrooms, bathrooms, square footage, type of construction, etc.). Once you have taken note of all of the major features, you then look for recent sales of properties that are as similar as possible to the subject property.

The idea is to find sales of sufficiently similar properties that occurred within the last twelve months or less (preferably less than six months) and in close proximity to the one being valued (preferably on the same street or at least the same neighborhood). This approach is fairly reliable and easy to do for single family homes, since these homes are the most abundant and data of their sales is plentiful.

The Income Approach.

Finally, the last approach is the income approach. And there are actually two types of income valuations that you may see. The first one is the Gross Rent Multiplier (“GRM”) method and the second one is the Capitalization Rate (“Cap Rate”) method.

Gross Rent Multiplier Method

The GRM is a number by which you would multiply the gross rent of the building you are trying to value. Following the methodology I am about to describe, the resulting amount should in theory be the building’s value.

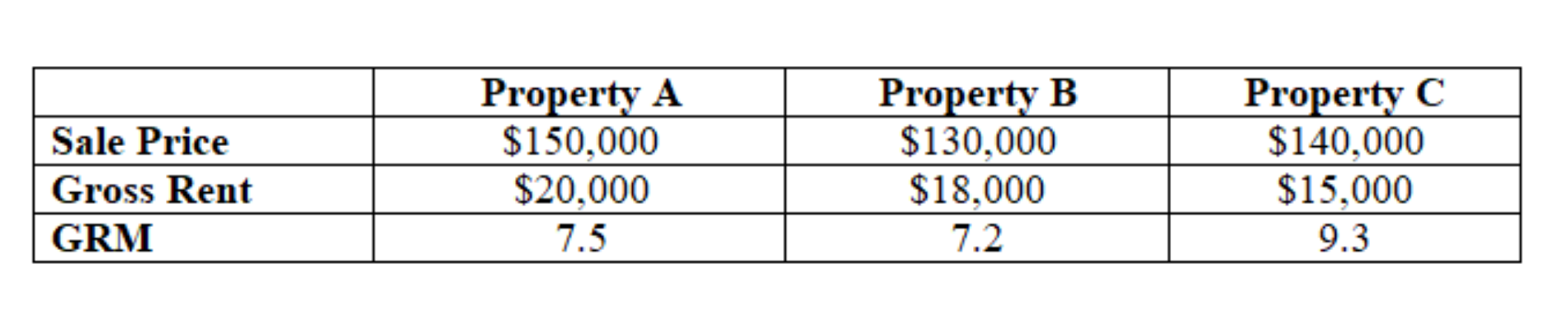

The GRM is derived by examining the relationship between the gross rents and the prices of rental properties that have recently sold in the same area. So, consider the example below.

In order to get the GRM for each property sold, you would divide the sale price by the gross annual rent. In order to determine what an appropriate GRM might be for the property you are trying to value, you would consider what the GRMs were for similar properties that previously sold. If you were to consider the GRMs for the three properties listed in the table, you may conclude that an appropriate GRM for your property might be somewhere around 8. If you know the gross annual income of the property you are trying to value, you could attempt to determine its market value by multiplying that income by the estimated GRM.

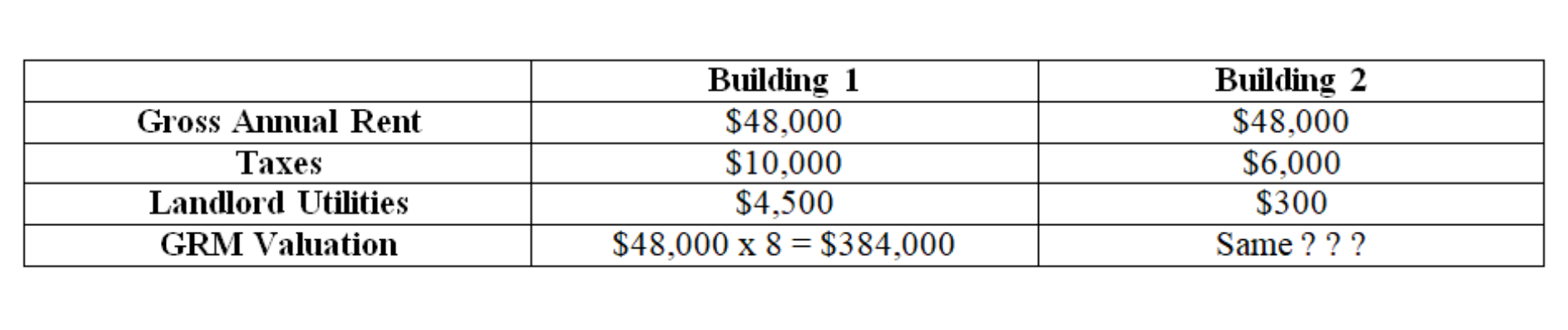

However, the problem with using the GRM method is that it does not take into account any expenses of the properties that were used to arrive at the GRM number. So, if, for example, you are trying to value two identical four unit buildings that had the same income, but different expense structure, the GRM method may give you an inaccurate estimate of value. Specifically, using the GRM method, the valuation for both buildings would be the same. However, the building with fewer owner-paid expenses would clearly be much more desirable to prospective purchasers, and would therefore be more valuable than the one with higher expenses.

Each building produces $4,000 in gross rent per month, which equates to $48,000 per year. Using the GRM method, you would think that both buildings have the same value.

But, what if one of those buildings has much higher taxes. Or, what if one of those building has one boiler that supplies heat to all four units, while the other building has separate furnaces in each unit. The owner of the building with the boiler will have to pay for the utility cost, while the owner with the four furnaces will not.

Clearly, if the expenses on one of the buildings are much higher, that building would be less desirable and be worth less, as the owner would make less income from that building. Because the GRM does not account for this, it is not a great way to accurately estimate a building’s value.

Cap Rate Method

This brings me to Cap Rate method. The Cap Rate method takes into account not only a property’s income, but also its expenses.

The way you arrive at value with this method, is you take the Net Operating Income (“NOI”) of a property and divide it by the Cap Rate. The Net Operating Income, the “NOI” is the difference between the property’s gross income and all of the property’s expenses, except for the cost of its financing (e.g. mortgage principal and interest). Let’s look at a quick example for how to figure this out.

Let’s say you are looking at a 10-unit apartment building. Each unit rents for $1,000 per month. So 10 units, times $1,000, equals $10,000 per month. Over 12 months, that comes to $120,000. That is your gross income.

Let’s also say that the annual expenses on this property are as follows:

Property taxes: $20,000;

Insurance: $5,000;

Utilities: $5,000;

Maintenance and Repairs: $10,000;

Capital Expenditures: $10,000;

Vacancy: $6,000 (5% of the gross rent);

Total Expenses: $56,000.

We then take the total of all expenses and subtract it from the $120,000 gross rent. The resulting number is $64,000. This is the Net Operating Income (the “NOI”) in this example.

So, now that we know the NOI, the next variable we need is the Cap Rate, which is expressed as a percentage. The Cap Rate is simply the amount of money that an average investor would be willing to receive as his or her return on investment.

The Cap Rate will vary depending on the area and the condition and type of the property. The easiest way to find out what the Cap Rate might be in the area where the property you are valuing is located, is by speaking with a commercial appraiser, agent, or lender. Those folks should be able to give you an idea of what the going Cap Rate is.

Once you know the Net Operating Income and the Cap Rate, you can figure out the value. An interesting thing about Cap Rate is that the lower the Cap Rate, the higher the valuation will be and vice versa.

If, for example, the Cap Rate is 10%, then in our hypothetical, the value of the building will be 640,000 dollars. That is, we took 64,000 dollars and divided it by 10% and we got 640,000. However, if the Cap Rate was 8%, then the value in our hypothetical would be 800,000 dollars. So, it is very important to use an accurate Cap Rate when trying to determine what a building might be worth. If you are unsure about the Cap Rate, then it may make sense to be more conservative and use a higher Cap Rate for your valuation.

Normally, a 10% Cap Rate is pretty conservative. There are much higher Cap Rates of course, but those are usually in pretty rough neighborhoods and are going to be very difficult buildings to own and manage. In more upscale neighborhoods and high appreciation areas, Cap Rates can be extremely low. It is not unusual to see Cap Rates in low single digits. In those areas, investors are willing to forego a high cash flow return on their money in exchange for the likelihood that the properties they buy will appreciate in value when they go to sell.

Cap Rate is the Most Reliable Method for Valuing Larger Multi-Family Properties.

So, why is the Cap Rate approach better for larger multi-family properties than the comparable sales approach. The reason is that unlike single family homes and small multi-family homes of two to four units, there are fewer bigger multi-family properties out there, so their sales are much more rare.

Typically, in order to obtain a valuation using a comparable sales approach, you need at least three sales of similar properties within the last 6 to 12 months in close physical proximity to the property you are valuing. With larger apartment buildings, close proximity sales are simply not common enough.

Additionally, even if you find other apartment sales in close proximity and time, they are likely to have very different features from one another. This also presents a problem for arriving at a reasonable valuation. The solution to these problems is to simply consider the income potential of those properties by using the Cap Rate method. This is the method that most commercial lenders will use for valuing properties of five units or more. If you are going buy one of those properties and use financing, you will have to use a commercial lender because residential lenders will not lend on buildings of more than four units. Cap Rate methodology is what they will likely use to determine whether they will lend you the funds to purchase the deal.

I hope this gives you a good idea of what the different valuation methods are and why the Cap Rate method might be better than the others. If you have any questions, please let me know in the comments!